From Business Credit to Business Capital.

Universal Recovery Consultants LLC is a Business Credit & Capital Strategy Company helping you transform your credit into funding, growth, and long-term financial empowerment.

Why Choose Us?

With years of experience in the Financial Consulting industry, we have built a reputation for quality, reliability, and customer satisfaction.

Expertise You Can Trust

Our team of professionals brings a wealth of knowledge and experience, ensuring you get the best results every time.

Tailored Solutions

We understand that every client is unique, which is why we take a personalized approach to meet your specific needs.

Commitment to Excellence

We are passionate about delivering top-notch service and results that consistently exceed all of your expectations.

Banks Don’t Fund People — They Fund structured Businesses

Most small business owners are denied funding not because they lack potential — but because they lack fundability.

Business credit changes that.

By building business credit correctly, you can access capital without personal guarantees, without risking your personal score, and without relying on high-interest loans or predatory lenders.

Business credit gives you:

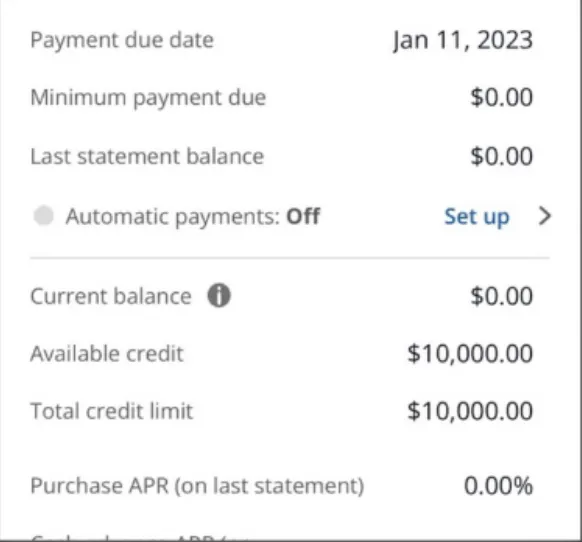

Higher limits

Faster approvals

No personal liability

More leverage to grow

We Will Meet All Of Your Needs!

100+

Five Star Reviews

100's

Satisfied Clients

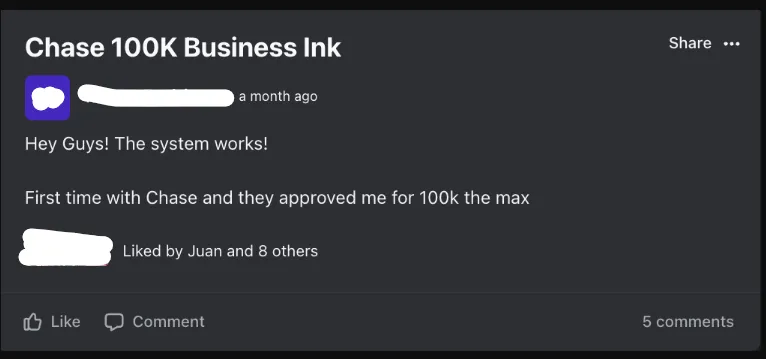

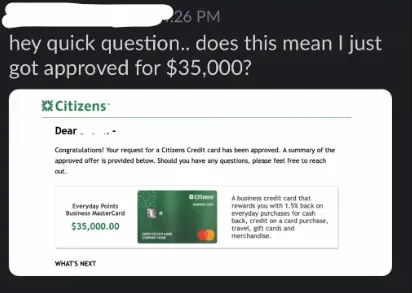

Don't Just Take it From Us

Testimonial

Anna G.

Testimonial

Rudy E.

Testimonial

Pete S.

Testimonial

Jacob D.

Let us guide your Business to thrive

Ready to Build Business Credit and Access Capital?

Kinected CoWorking

10401 I-10 W

San Antonio, TX 78230

© 2025 Universal Recovery Consultants LLC - All Rights Reserved